July 20, 2021 (Global News Distribution) -

Everything you need to know about the 7702 tax law changes, explained by two financial advisors.

A new window of opportunity has opened up for consumers who have or who are interested in buying permanent life insurance.

Financial advisors Marshall Gifford and Shaun McDuffee are teaming up to break down the 7702 Tax Law Changes so you can make informed financial decisions.

Here is what you need to know and how you can take advantage of these changes:

What is the 7702 Tax Law?

The 7702 Tax Law is the IRS code that establishes the rules around permanent life insurance. It governs how much money an individual can put into a life insurance policy and still retain the definition and tax treatment of life insurance.

The tax law currently says that the death benefit-when received by beneficiaries- is a tax-free event, and the internal buildup of cash value is also a tax-favoured event. This means there is no current taxation of that money as it grows.

The 7702 Tax Law is important because it had interest rate assumptions ingrained in the rules that determined how much money someone could put in.

For higher-income individuals who have maxed out their retirement plans and taken advantage of the tax-preferred vehicles, but still have money they want to utilize, the unique rule would permit them to put excess premiums into their permanent life insurance with the benefit of their excess money accumulating on a tax-favoured basis and coming out of the life insurance policy on a tax-favoured basis.

But the rules have changed to allow higher contributions.

What is the new rule?

Let’s break this down with an analogy:

Imagine that you are creating a bowl from a block of wood. The government told you how deep you can make the bowl. But now, the government changes the regulations and allows you to hollow out more of the block, making the bowl deeper, and able to hold more water. The block is the same size and cost, but because of the rule change, it can hold more water, which you appreciate!

Essentially, your life insurance policy is the same size, and the cost isn’t affected by the rule, but you can contribute more money, and build more cash value!

While this new policy is positive (in theory) for the consumer, lower interest rate assumptions in the contribution limits mean you can contribute higher premiums. This is because when a lower interest rate is used, you need to invest more money to get to the same dollar amount in the future. However, the actual rate of return you can earn on your money once in the policy didn’t change. Only the interest rate that can be used in determining what you can contribute changed.

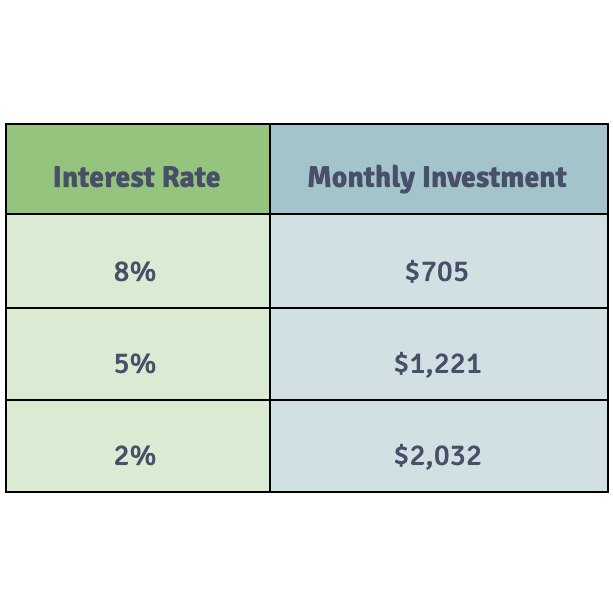

For example, if you want $1 million in 30 years, the table below illustrates how much you would need to invest each month to reach your goal based on the interest rate*:

- with an 8% interest rate, you’d need to invest $705 a month

- with a 5% interest rate, you’d need to invest $1,221 a month

- with a 2% interest rate, you’d need to invest $2,032 a month

*This hypothetical example is for illustrative purposes only. Not based on any particular investment. Investments will fluctuate and when redeemed, may be worth more or less than originally invested.

“All that really changed is that the discount rate insurance companies can use to calculate maximum premium went from 4% to 2%. Now that [insurance companies] are using a 2% interest rate, you get to contribute more money,” says Founder & Senior Partner of Gifford Financial, Marshall Gifford.

What does this mean for your permanent life insurance policy?

Traditionally, permanent life insurance has been given a bad rap. It’s common for people to believe permanent life insurance is too expensive and choose other methods of investing. But choosing this type of life insurance comes down to what you are trying to accomplish.

“Permanent life insurance isn’t bad or good. It’s just a tool,” says Senior VP of North Star Resource Group, Shaun McDuffee, “For those looking to shelter money and for those wishing to build wealth and pass it on, [permanent life insurance] has become a more effective tool.”

This game-changing policy offers a more efficient accumulation solution for consumers looking for retirement planning options.

Why did this happen?

A combination of factors led to this upgraded policy. Since 1984, the IRS-7702 rate has been 4%. As of January 1, 2021, the interest rates were lowered.

This change may have been an unintended consequence, given the current administration’s stance on taxes and the wealthy. But it is also a vehicle that helps the average American reduce risks and access affordable life insurance while accumulating wealth.

What Should You Do?

If you are against permanent life insurance or if you already have it, take a second look. Talk to your financial professional and make sure they are up to date regarding permanent life insurance policies as of this year.

This change is recent, and may not be included in older materials.

Learn More About Permanent Life Insurance

To learn more about this topic and see if permanent life insurance is right for you, please contact Marshall Gifford, Founder & Senior Partner of Gifford Financial or Shaun McDuffee, Senior VP of North Star Resource Group.

Source: Schmidt, Channing, J.D., CFP, Advanced Sales Director. Individual Solutions Team, Securian Financial Group, Inc.

North Star Consultants, Inc. – Insurance Products and Services. CRI Securities, LLC – Securities and Investments. Securian Financial Services, Inc. – Variable Products and Securities. Securities and investment advisory services are offered through CRI Securities, LLC and Securian Financial Services, Inc. Members FINRA/SIPC. CRI Securities, LLC is affiliated with Securian Financial Services, Inc. and North Star Resource Group. North Star Consultants, Inc. is doing business as North Star Resource Group and is independently owned and operated. Gifford Financial is affiliated with North Star Resource Group but is independently owned and operated.

Marshall and Shaun are registered representatives and investment advisor representatives of CRI Securities, LLC and Securian Financial Services, Inc.

3662028/DOFU 7-2021

Financial Professionals do not provide tax or legal advice and this should not be considered as such. Please consult a tax or legal professional for advice regarding your specific situation.

Please keep in mind that the primary reason to purchase a life insurance product is the death benefit.

Life insurance products contain fees, such as mortality and expense charges (which may increase over time), and may contain restrictions, such as surrender periods.

Contact:

Company Name: Gifford Financial

Contact Person: Marshall W. Gifford

Address: 2701 University Avenue S.E., Ste 100, Minneapolis, MN 55414

Send Email

Phone Number: 612-617-6119

Website Link: http://www.giffordfinancial.com/

SOURCE: Gifford Financial